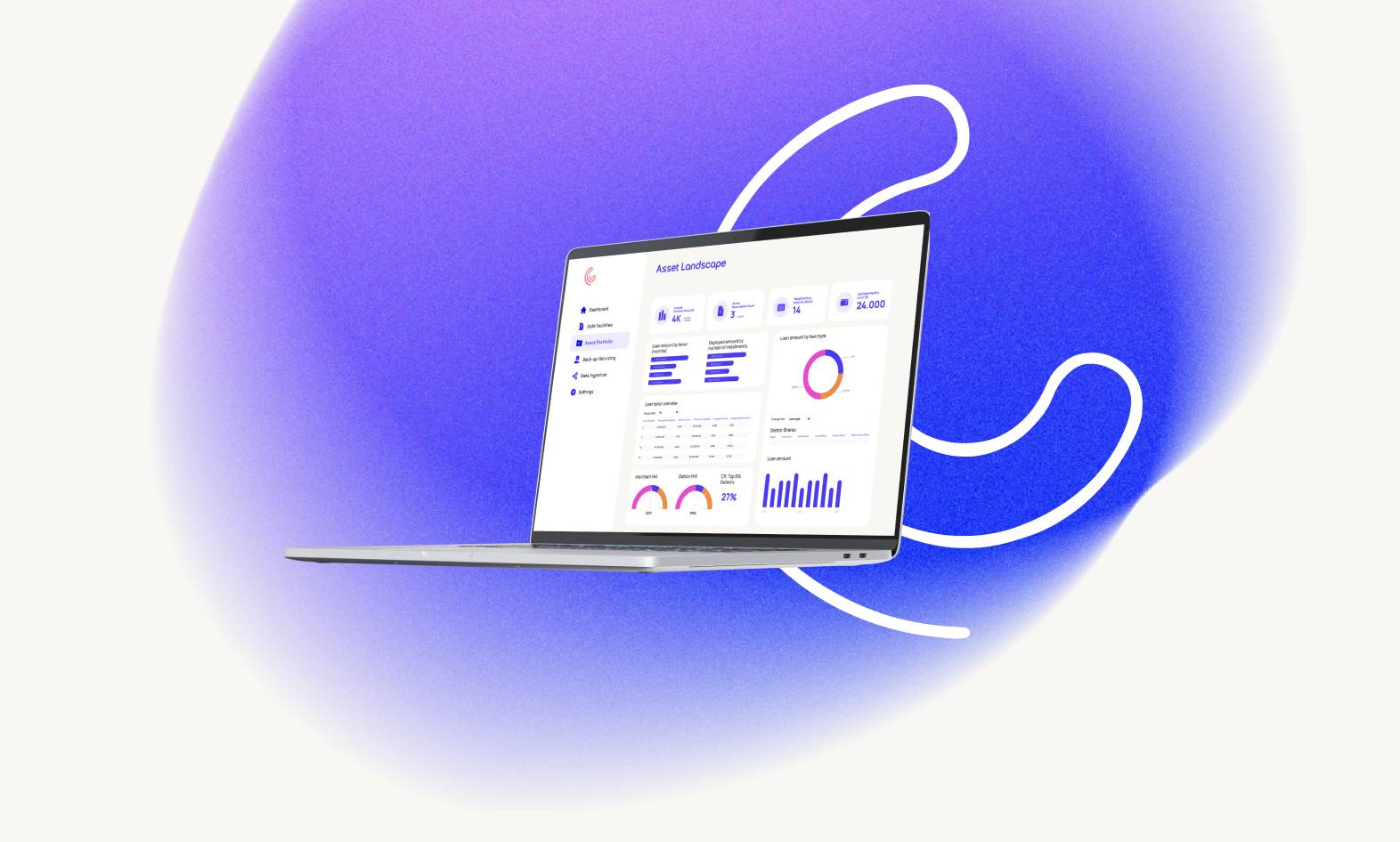

The Credibur platform

Credibur helps borrowers and lenders manage debt facilities with automated, real-time data, and a modular backend for everything from drawdowns to SPV management.

Automation &

Monitoring

Trigger-based workflows for drawdowns, repayments, eligibility checks, and covenant tracking – without manual Excel processes.

Analytics &

Dashboards

Real-time facility performance, breach alerts, waterfall projections, and lender-ready reporting.

Security &

Integrations

Secure by design. Bank-grade encryption, full audit trail, and integration with accounting systems, CRMs, and cloud storage.

Automate your debt facility management

Data acquisition

Credibur automatically acquires asset, repayment, and entity data from your internal systems with a simple integration. Every single asset is validated and automatically assigned to the right portfolio, entity and facility - no Excel work required. Manual reassignment is possible via an easy-to-use interface.

Automated drawdown

The platform suggests funding requests or purchase offers based on asset inflows and facility limits. Upon approval, all documents are generated and sent to the lender – ready for execution.

Covenant tracking

Monitor all covenant thresholds and portfolio constraints in real time. Get notified before limits are breached, and track performance across all facilities in one view. Generate compliance reports for lenders with one click.

Lender reporting

Generate lender-specific reporting files automatically across facilities and entities, directly pushed to your lender's API, server, or email. Access real-time views of collateral performance, waterfall projections, and compliance status.

Beyond the platform

Backup servicing

As a neutral, tech-first backup servicer, we take over communication, payments, and reporting within minutes. This means no extra parties, no excessive fees.

SPV setup & management

We help structure and operate dedicated SPVs. With trusted partners we automate bookkeeping, reporting, and legal coordination.

Debt fundraising support

While we are not brokering deals, we are proud to work closely with some of the best debt providers and brokers and are happy to help our customers close facilities.

Portfolio structuring support

We help originators define eligibility criteria, concentration limits, and portfolio rules – based on real-world transactions.

Ready to automate

your portfolio management?