News & Insights

Stay updated with the latest news, articles, and insights from Credibur.

Backup Servicing and the Cost of Being Unprepared

Backup servicing only becomes visible once something has gone wrong. Its value then depends less on contractual appointment and more on whether a reliable operational view of the portfolio can be established quickly enough to support decisions.

Our founder Nicolas Kipp recently spoke with Kevin Hackl from leading German industry podcast Payment & Banking about how Private Credit works, the different players involved, and what he has learned building companies in this space.

Non-bank digital lending in Europe is growing rapidly. Yet despite this growth, many loan portfolios are still managed using Excel spreadsheets, PDFs, and long email threads.

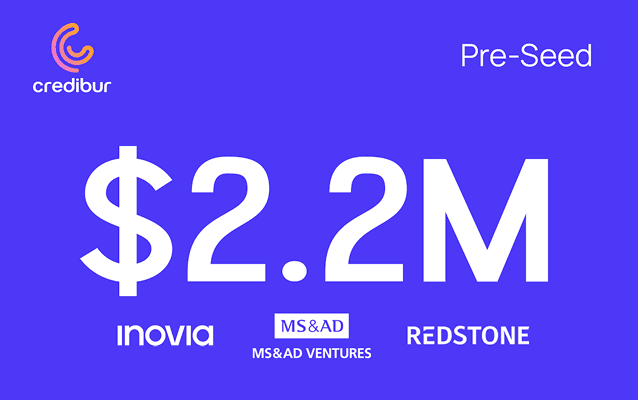

Credibur appoints Anja Kuehnel as VP Operations to strengthen finance, people, process and communications. The Berlin fintech builds digital infrastructure for structured credit and recently raised a 2.2 million dollar pre-seed round.

Credibur was selected among the Top 3 finalists of the Fintech Newcomer Award at DigiFin25 in Berlin, a leading event focused on digital innovation in financial services.

Speed has become a decisive competitive advantage in financial services. Yet in Germany, execution is still too often blocked by regulatory complexity, slow decision cycles, and a risk-averse mindset.

Non-bank lending is growing rapidly, yet refinancing still relies on largely analog structures. Why the digitalization of these processes is becoming a central prerequisite for efficiency, transparency, and growth in the credit market.

Berlin, 23rd July 2025 – Berlin-based FinTech Credibur has secured $2.2 million (€1.85 million) in pre-seed funding to launch its credit infrastructure platform. The round is led by European FinTech VC Redstone, followed by Silicon Valley's MS&AD